-

Collateral Pools

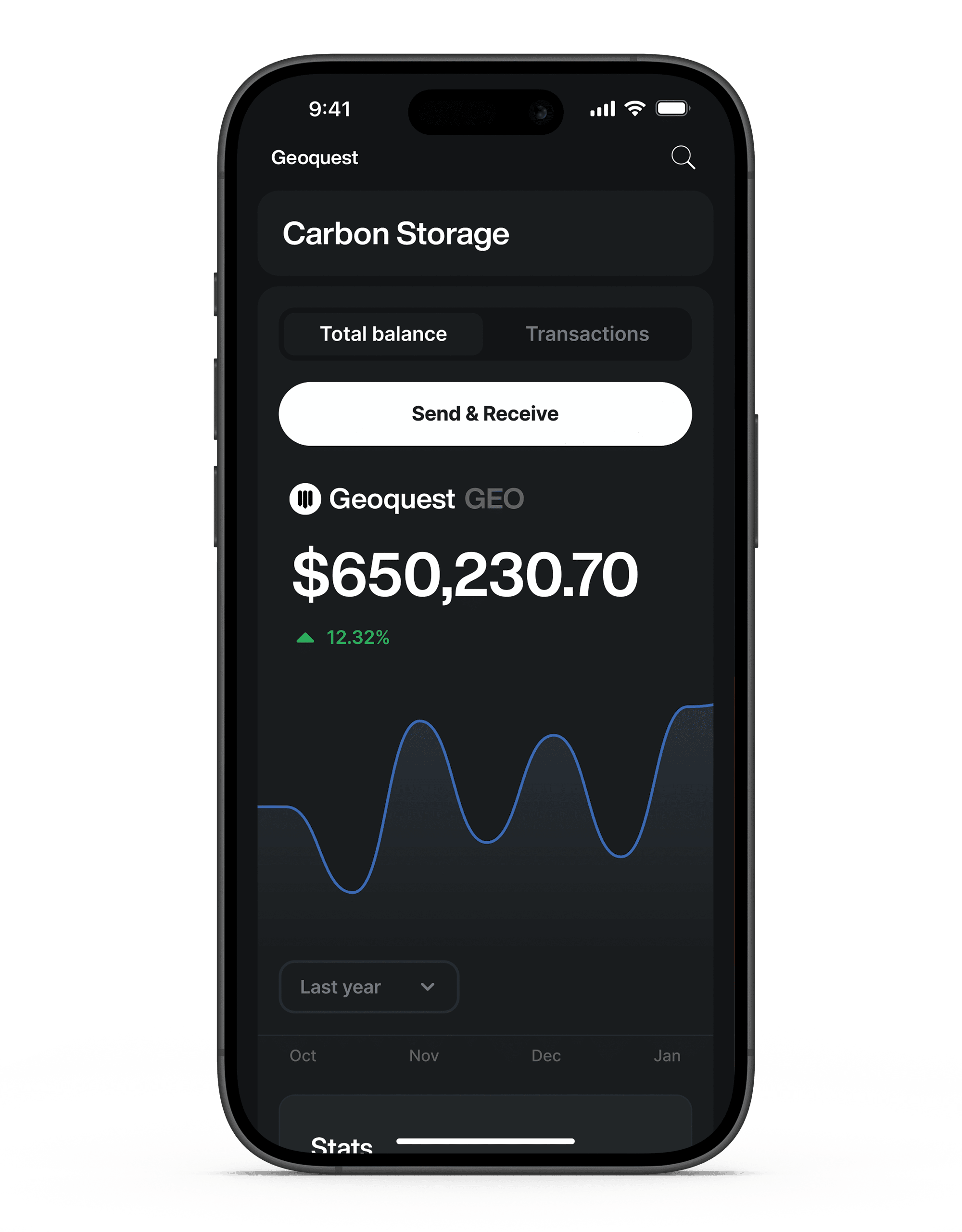

Each GEO token is backed by geological carbon storage assets, ensuring stability and value reflective of the underlying collateral. The collateral pools are divided into several categories to support the ecosystem:

- Exchange Pool: Provides a basis for exchange-traded derivatives.

- Market Maker Pools: Ensure liquidity and facilitate price discovery by balancing buy and sell orders.

- Buffer Reserve Pool: Collects fees to buffer volatility and fund ecosystem needs, enhancing stability and resilience.

-